If Credit Suisse decides to issue shares to fund its restructuring plans, the plunge in its stock price this year will make a capital raise much more dilutive for existing shareholders. Coming up next week: earnings reports from big banks, consumer and producer inflation, retail sales, and consumer confidence. The larger spread suggests investors now see a far higher chance of the bank defaulting on its debts.

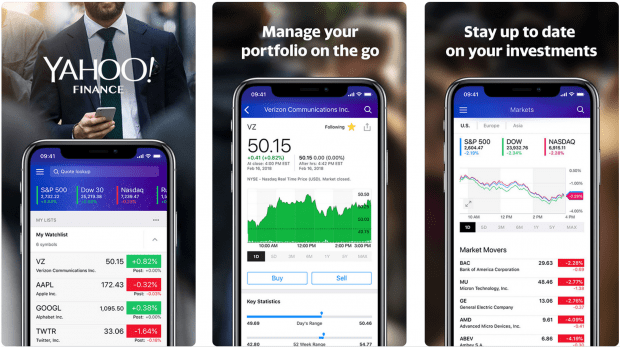

Moreover, the spread on five-year credit-default swaps (CDS), which investors often buy as insurance against a company defaulting, climbed as high as 350 basis points, up from about 55 basis points at the start of this year, the FT reported. As central banks around the world move to stem inflation, BofA. Bad news for Credit SuisseĬredit Suisse shares fell as much as 12% on Monday morning, extending their decline this year to 60%. The bond market is in the middle of a historic crash and itll hammer stocks, according to a Friday note from Bank of America. The BoE also liaised with Swiss authorities after the Credit Suisse memo added fuel to the firesale in markets, The Telegraph reported. Senior bank executives rushed to reassure large clients, counterparties, and investors about their liquidity and capital position over the weekend, the Financial Times reported. A large Credit Suisse investor told a Fox reporter the bank's investment arm is a "disaster," and the lender's credit-default swaps were trading as if a "Lehman moment was about to hit." Instead of calming anyone, the memo set Twitter and Reddit alight with wild predictions of the bank imploding and triggering the collapse of the global financial system. In this case, Credit Suisse CEO Ulrich Koerner told staff in a Friday memo that it was a "critical moment" for the bank ahead of the unveiling of its restructuring plan on October 27, and they should expect more market volatility. With all that kindling, it should be no surprise that a spark would cause a massive blaze. The backlash spurred Prime Minister Liz Truss and her team on Monday to scrap their planned removal of the top rate of income tax. The news sent the British pound to a record low against the US dollar, spiked the UK government's borrowing costs, and prompted a rare Bank of England intervention. Real-time price data, business summary, key analytics metrics, price performance charts. The new UK government also roiled markets last week by announcing a slew of unfunded tax cuts and spending programs, which fueled fears of worse inflation and more rate hikes. Koyfin is a good alternative to Yahoo Finance. Rampant inflation, soaring interest rates, early signs of a global economic downturn, and tumbling asset prices have spooked investors in recent months, and made them worry about what's coming next. The case for strong stock-market returns for the rest of the year hinges on avoiding a recession and is compounded by the fact that many asset classes are trading 60 to 80 below their highs. The weekly AAII investor survey has started to flash those bearish extremes in recent weeks, with the survey registering its fourth most bearish reading on record, and the CNN Fear and Greed Index remains in "Fear" territory.Credit Suisse is fending off concerns about its financial health, with some investors going as far as suggesting the Swiss bank is at risk of suffering a Lehman Brothers-style collapse that could upend the global financial system. That can serve as a powerful contrarian indicator of a bottom when sentiment hits extreme levels. The average stock market gain in the month of October alone is 1.0% during mid-term election years, compared to just 0.3% in all other years, according to Newton.Īnd investors are no longer as bullish on stocks like they used to be amid the near-25% decline in the S&P 500. Mid-term election years bode well for strong stock market performance in the fourth quarter, based on historical data. The bullishness from Newton is derived from a combination of favorable seasonal trends, depressed investor sentiment, and a strong market bounce so far this week. stock market will be further challenged in the week ahead as the. The firm highlighted favorable seasonal trends. The stock market has likely found its bottom this week and should stage a rally of up to 15% heading into year-end, Fundstrat's technical strategist Mark Newton told clients in a Monday note. Oct 4, 2022, 11:47 AM Spencer Platt/Getty Images The stock market has likely bottomed this week and could stage a 15 rally, according to Fundstrat.

0 kommentar(er)

0 kommentar(er)